Temporary expansions made unemployment insurance a lifesaver. Workers need long-term reform to keep it that way.

By Justin Schweitzer

By April 2020, two months into the pandemic, the unemployment rate reached a staggering 14.7%—leaving 23 million workers and their families without earned income. Job losses were largest among low-wage workers, who are disproportionately young workers, women, and people of color. Meanwhile, state unemployment insurance (UI) systems, which were quickly overwhelmed with applicants, had low benefit amounts, long wait times, and low rates of recipiency even for those eligible for UI. Without quick action from Congress, UI programs could not meet the immense need catalyzed by the pandemic.

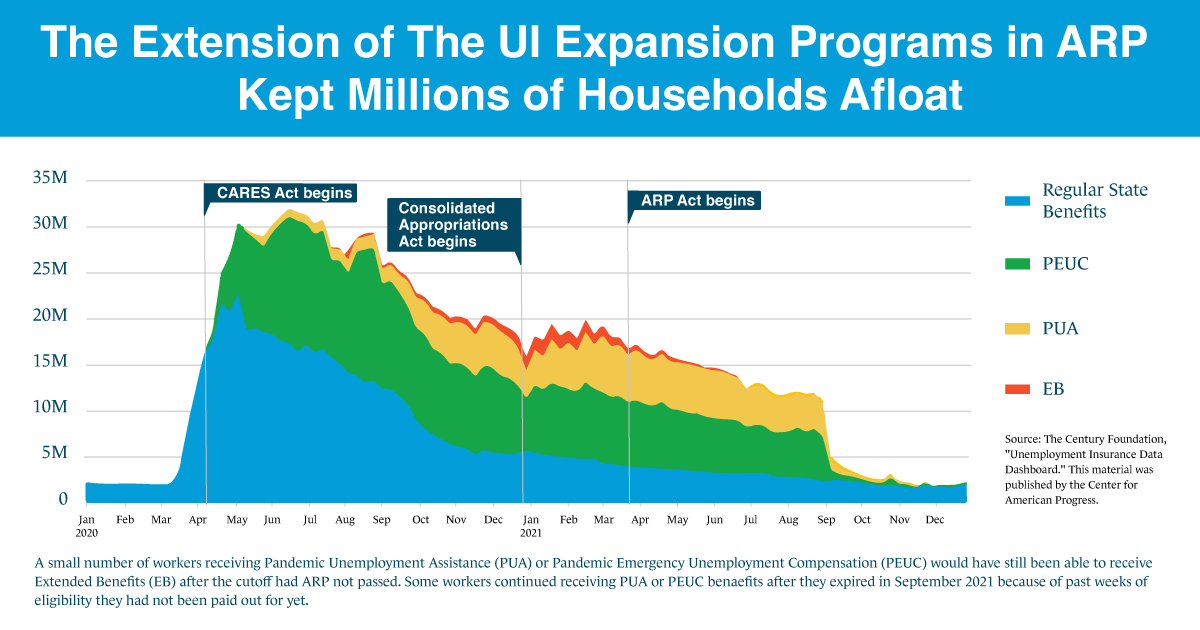

The Coronavirus Aid, Relief, and Economic Security Act (CARES), passed in March 2020, expanded UI by creating three new programs that significantly increased benefit levels, extended the number of benefit weeks available, and expanded eligibility, respectively.[1] In the first year of COVID-19, one in four American workers relied on UI benefits to weather job loss during the pandemic. Largely because of these expansions, UI kept 5.5 million people, including 1.4 million children, out of poverty in 2020.

When the American Rescue Plan (ARP) passed in March 2021, there were still almost 11 million fewer jobs in the labor market than before the pandemic. The ARP extended the enhanced UI programs created under the CARES Act,[2] preventing almost 13 million struggling workers from losing their unemployment benefits entirely on March 14, 2021.[3]

A robust UI system benefits both workers and the economy as a whole. UI protects workers and their families from significant hardship, provides substantial stimulus to the economy to counteract recessions, and boosts worker power to demand better pay and conditions. However, this safety net is shamefully inadequate.

Without the federal expansions, access to UI is extremely limited and benefit levels are too low to live on, with wide inequities among states in both access and benefit. Prior to the pandemic, benefits replaced just 45% of wages on average and only 29% of eligible workers actually received those benefits. Two years later—with the expansion of benefits under CARES and ARP fully expired—the UI recipiency rate had returned to 29% and the replacement rate was down to 43% of wages on average.

Furthermore, UI systems in every state have been underfunded and allowed to deteriorate for decades. UI systems are filled with administrative burdens that make application and eligibility processes confusing. Many applicants don’t complete the process to receive benefits and those who do can be stuck in limbo for weeks or months waiting for their benefits. Much of the UI technology that states use is also woefully out-of-date, which causes long wait times and backlogs, and can make the system susceptible to fraud.

The ARP gave the Department of Labor $2 billion to modernize UI systems, prevent fraud, and promote equitable access to benefits. The Biden administration has taken important steps here: helping states upgrade their UI systems, sending “tiger teams” of experts to help states simplify their applications and better prevent fraud, creating a shared software for UI systems that all states can use, and piloting UI Navigator programs to assist with complicated application processes.

While administrative fixes can make UI systems easier to navigate and better prepared to handle large influxes of applicants during economic crises, we need additional changes to ensure the program works for everyone. Benefit levels are currently too low to live on and far too many people are ineligible for UI at all because of the specific job they hold, like independent contractors, gig workers, and tipped workers. Meanwhile, many states cut benefits during good economic times rather than raise taxes to fund their systems properly. Only structural reform from Congress and sustained investment can create a permanent UI system as effective as the one temporarily enacted during the pandemic.

Unemployment insurance typically gets neglected until a recession hits and it’s too late to fix everything for the crisis at hand. The short-term fixes in ARP and CARES went a long way to stabilizing the system, but that funding was a temporary solution. Now is the time to build on the administration’s investments for long-term, structural UI reform to ensure workers, families, and the economy can weather future recessions.

Justin Schweitzer (he/him)

Justin Schweitzer is a Policy Analyst with the Poverty to Prosperity team at the Center for American Progress.

[1] See TalkPoverty, “Unemployment Insurance: Unemployment benefit changes in the CARES Act (March 2020).”

Pandemic Unemployment Compensation (PUC) boosted weekly benefits by $600.

Pandemic Emergency Unemployment Compensation (PEUC) provided an additional 13 weeks of eligibility.

Pandemic Unemployment Assistance (PUA) expanded benefit eligibility to workers who are generally not eligible for UI, such as gig workers and those with irregular or insufficient work histories.

[2] The PUC benefit was set to $300 in the ARP rather than $600 like it was in the CARES Act.

[3] The ARP also made the first $10,200 in unemployment benefits received in 2020 tax-exempt, providing needed relief to the approximately 40 million workers who had lost jobs or livelihoods during the pandemic and received some UI benefits in 2020. Additionally, the ARP provided $2 billion to modernize UI systems, prevent fraud, and promote equitable access to benefits.